Our Strategies

Three proven approaches to TSP investing, each optimized for different risk tolerances and return objectives

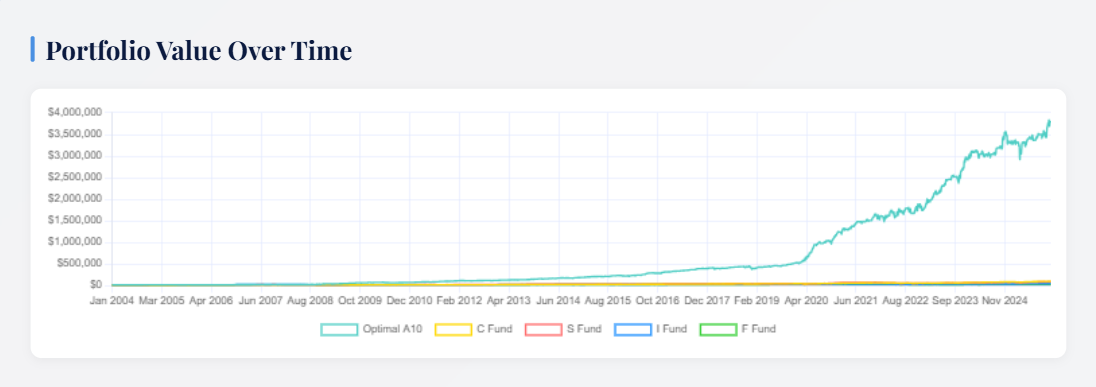

A10 Strategy

Optimal 10 Year Performance

Based upon a 20 year backtest with an initial $10,000 investment

Strategy Overview

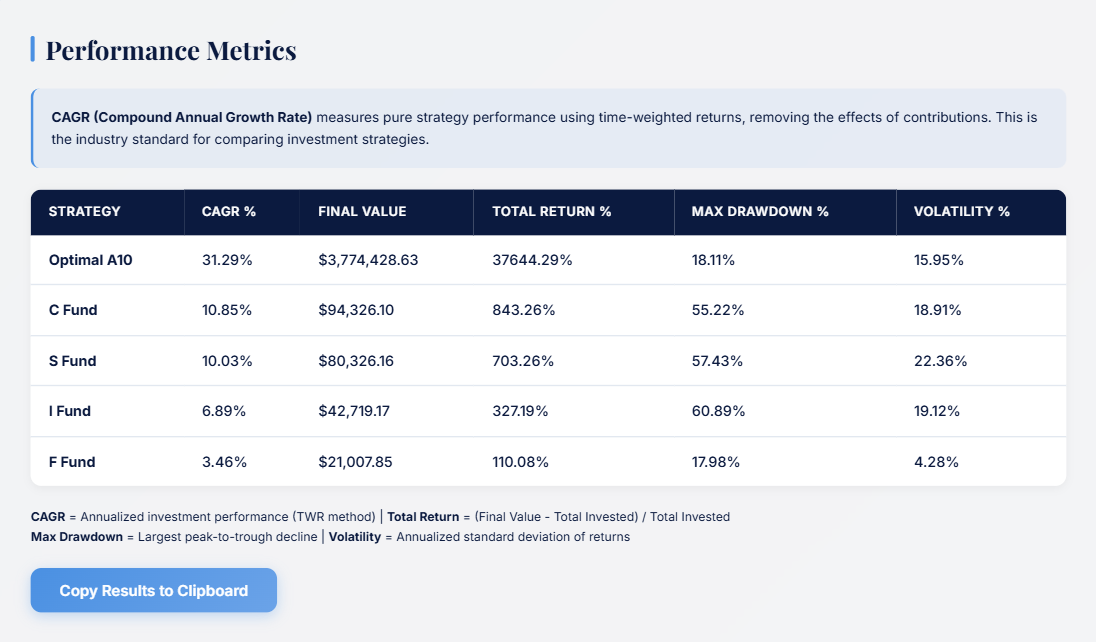

The A10 Strategy represents our most sophisticated approach to TSP investing. By strategically allocating across all five core TSP funds (G, F, C, S, and I) based on proven seasonal patterns, A10 achieves exceptional returns while maintaining reasonable risk levels.

Key Features

- Dynamic allocation across all core TSP funds (G, F, C, S, I)

- Optimized for maximum long-term growth

- 21-year backtest demonstrates consistent outperformance

- Strategic rebalancing based on seasonal market patterns

- Lower volatility than individual fund holdings

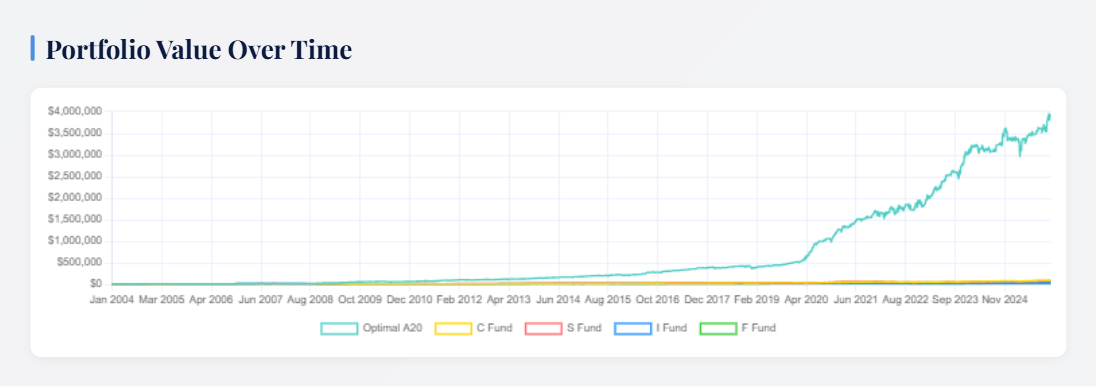

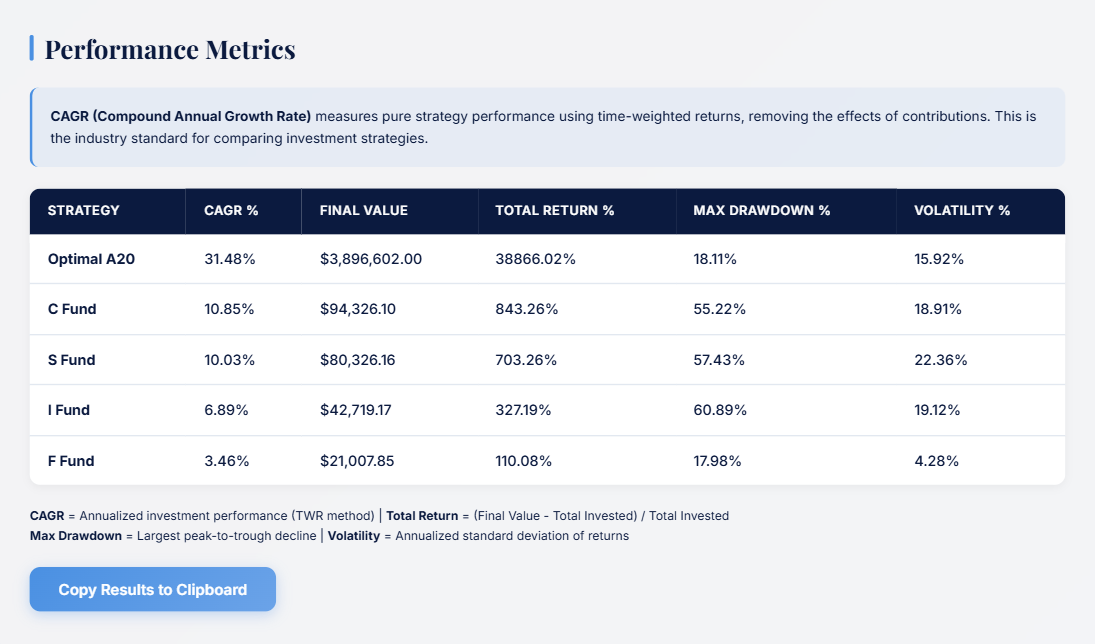

A20 Strategy

Optimal 20 Year Performance

Based upon a 20 year backtest with an initial $10,000 investment

Strategy Overview

The A20 Strategy offers an excellent balance between growth and stability. By strategically allocating across all five core TSP funds (G, F, C, S, and I), A20 provides strong returns with consistent performance—ideal for investors seeking robust growth with reduced volatility.

Key Features

- Balanced allocation across all core TSP funds (G, F, C, S, I)

- Strong returns with enhanced stability

- Excellent risk-adjusted returns

- Suitable for moderate to aggressive investors with steady growth

- Proven performance across multiple market cycles

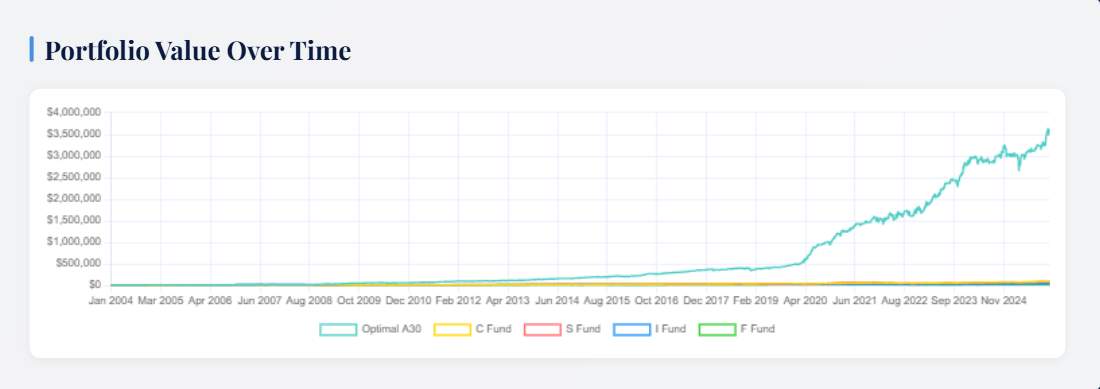

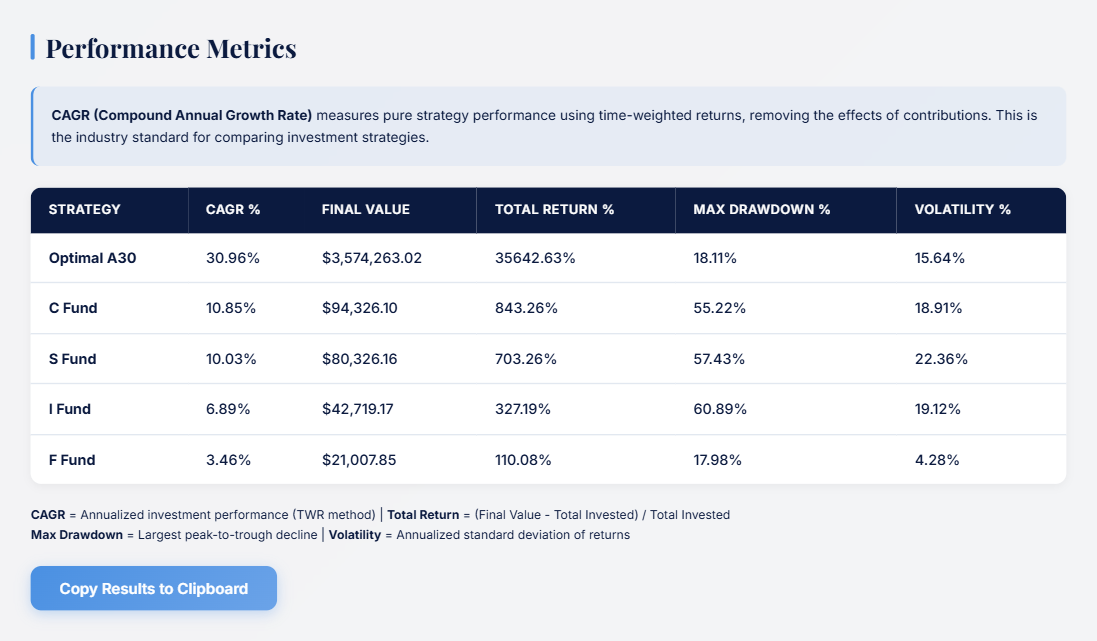

A30 Strategy

Lowest Volatility

Based upon a 20 year backtest with an initial $10,000 investment

Strategy Overview

The A30 Strategy prioritizes capital preservation while still delivering impressive returns. By strategically allocating across all five core TSP funds (G, F, C, S, and I) with a conservative approach, A30 provides the lowest drawdown with consistent strong returns—perfect for conservative investors or those approaching retirement.

Key Features

- Conservative allocation across all core TSP funds (G, F, C, S, I)

- Lowest volatility and drawdown risk

- Steady, reliable returns over time

- Ideal for pre-retirement or risk-averse investors

- Still significantly outperforms buy-and-hold